Introducing Stripe Integration for Revenue Intelligence

ThriveStack is proud to introduce the Stripe Integration for Revenue Intelligence, a new capability that gives revenue leaders complete visibility into recurring revenue performance and account-level insights. By integrating directly with Stripe, ThriveStack connects revenue, product, marketing, and customer success data to reveal how every team contributes to growth.

With this release, leaders can monitor recurring revenue health, detect payment and churn risks, and analyze expansion opportunities in real time — all without needing separate financial dashboards or data engineering work.

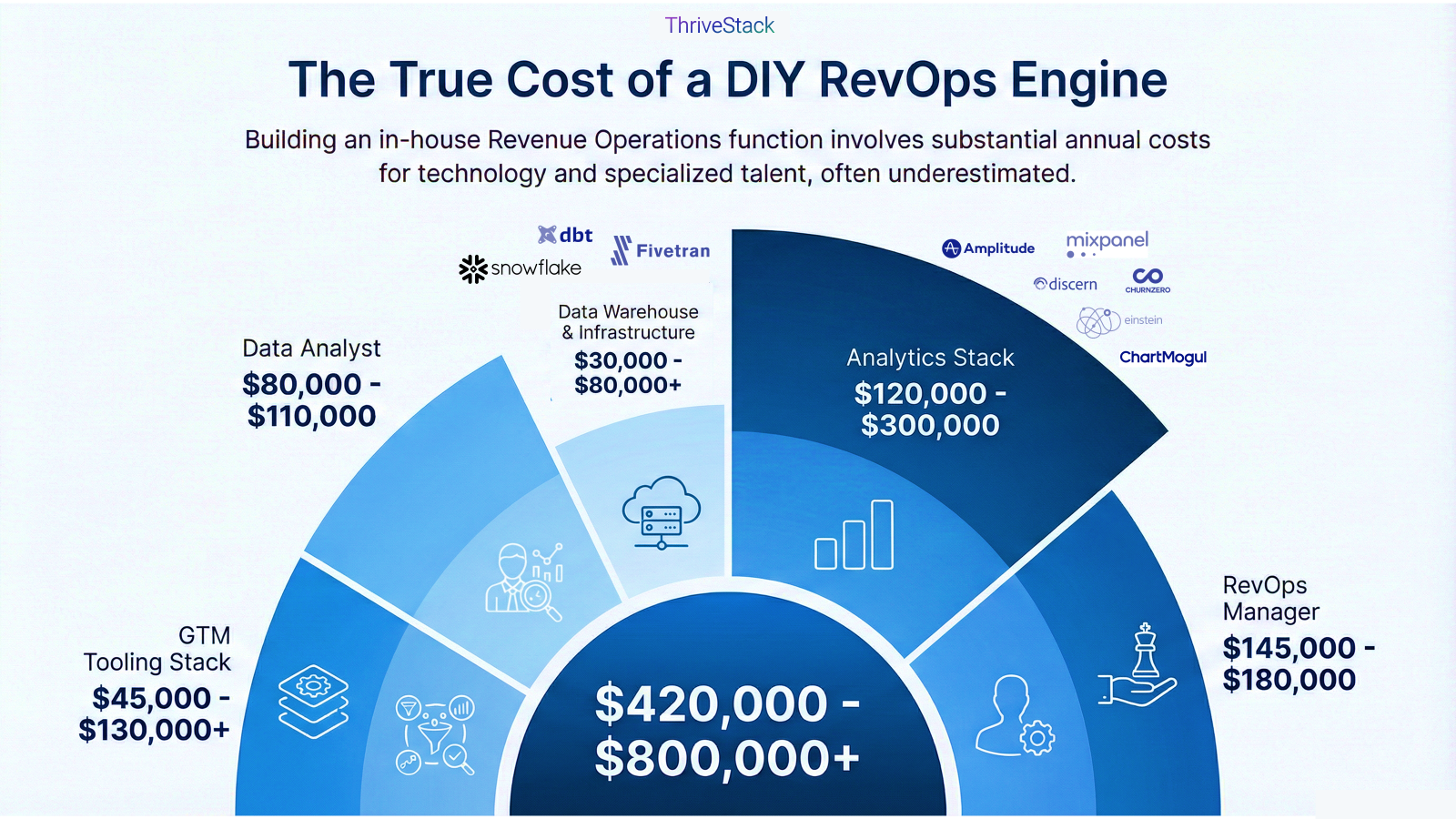

The Problem: Fragmented Revenue Data Limits Growth

Stripe powers some of the fastest-growing SaaS companies — yet many teams still lack visibility into how payment data connects to overall revenue health. ThriveStack’s integration closes that gap by unifying Stripe’s financial insights with marketing, product, and customer success data.

Here’s why this integration matters:

By consolidating these metrics in real time, the Stripe Integration provides cross-functional clarity — helping teams act faster to protect and grow recurring revenue.

ThriveStack's Solution: Unified Revenue Intelligence with Stripe

ThriveStack's Stripe Integration for Revenue Intelligence directly addresses these challenges by:

- Connecting Billing Data with GTM Insights: Seamlessly integrate Stripe billing data with your existing marketing, sales, and product usage data within ThriveStack.

- Providing Real-time Revenue Visibility: Gain instant access to key recurring revenue metrics, subscription health, and payment lifecycle events.

- Automating Data Correlation: Eliminate manual data exports and complex spreadsheets with automated correlation of financial signals to customer journey touchpoints.

Feature Highlights

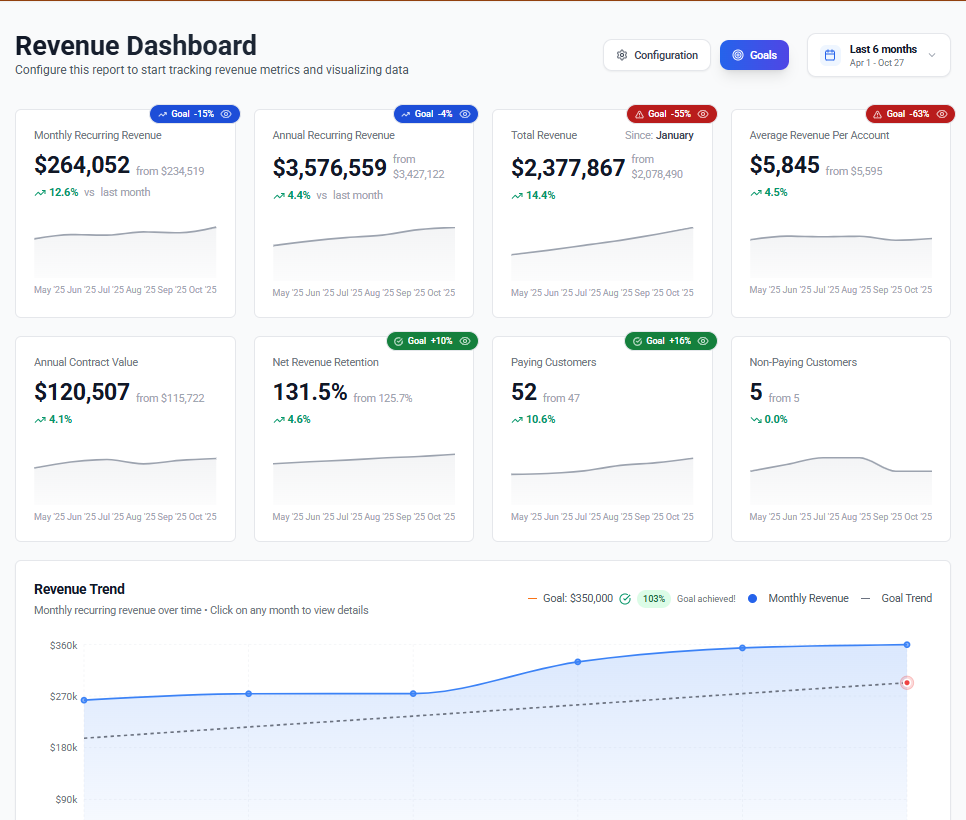

1. Unified Revenue Metrics

Track ARR, MRR, churn rate, LTV, and other critical financial KPIs directly alongside product engagement and marketing attribution.

2. Real-time Revenue Health

Monitor subscription statuses, payment failures, and dunning events in real time to proactively manage churn.

3. Account-Level Revenue Insights

Drill down into individual accounts to understand their billing history, subscription changes, and potential for upsell or cross-sell.

4. Churn Risk Detection

Receive proactive alerts for churn spikes, payment failures, or sudden changes in active seat counts, enabling teams to take immediate action, or other financial signals combined with product usage data.

5. Expansion Opportunity Analysis

Pinpoint high-potential accounts for expansion by correlating current subscription levels with product adoption and engagement.

6. No-Code Setup

Quickly connect your Stripe account to ThriveStack without requiring extensive data engineering or coding expertise.

Key Benefits for Revenue Leaders

With ThriveStack's Stripe Integration, revenue leaders can expect the following:

Strategic Impact

Operational Advantages

- Empower every GTM team with access to reliable revenue insights

- Eliminate manual reporting between finance and RevOps

- Detect churn and expansion signals faster with AI-driven insights

- Strengthen forecasting accuracy and renewal management

Customer Testimonial

“Connecting Stripe data directly into ThriveStack gave us a complete view of our recurring revenue. We can now track expansion, churn, and payment health in real time — it’s completely changed how we forecast and prioritize accounts.” — David Lin, VP Revenue Operations

Availability

Experience how ThriveStack’s Stripe Integration for Revenue Intelligence can transform your revenue operations.

The Stripe Integration for Revenue Intelligence will be live for all ThriveStack users on November 1, 2025.

Frequently Asked Questions

1. What is the ThriveStack Stripe Integration for Revenue Intelligence?

It's a new capability that directly integrates your Stripe billing data with ThriveStack's revenue intelligence platform, providing a unified view of recurring revenue, product engagement, and GTM data.

2. Who is this feature for?

This integration is designed for SaaS Revenue Leaders, RevOps teams, CFOs, and other stakeholders who need a complete, real-time understanding of their recurring revenue performance and customer journey.

3. Does it help non-finance teams too?

Yes. Marketing, Product, and Customer Success teams can finally see how their activities impact recurring revenue — enabling smarter retention and growth strategies.

4. What kind of data does the integration provide?

It provides key financial metrics (ARR, MRR, churn), subscription details, payment events, and combines these with product usage, marketing attribution, and sales activities for a holistic view.

5. Is it difficult to set up?

No, the Stripe integration is designed for a quick and easy, no-code setup, allowing you to connect your account in minutes.

6. How does this help with churn prevention?

By unifying billing data with engagement signals, it helps identify accounts with payment issues or declining usage patterns that indicate a higher risk of churn, allowing for proactive intervention.